State’s health care community anxiously awaits decision on federal Rural Health Transformation Fund

By Meera Mahadevan , Granite State News Collaborative

New Hampshire’s 13 rural hospitals — long under financial distress and some even at risk of closure — are waiting eagerly to see if they will get some relief from the federal government before the end of the year.

A report from a Pittsburgh-based think tank, the Center for Healthcare Quality and Payment Reform, says 30% of rural hospitals in the U.S. are at risk of closing mainly because of inadequate payments from health insurance plans and drastic cutbacks in Medicaid.

At least four hospitals in New Hampshire face the risk of closing, the report says, with two facing an immediate threat, based on the organization’s extensive analysis of hospital finances submitted to the Centers for Medicare and Medicaid Services.

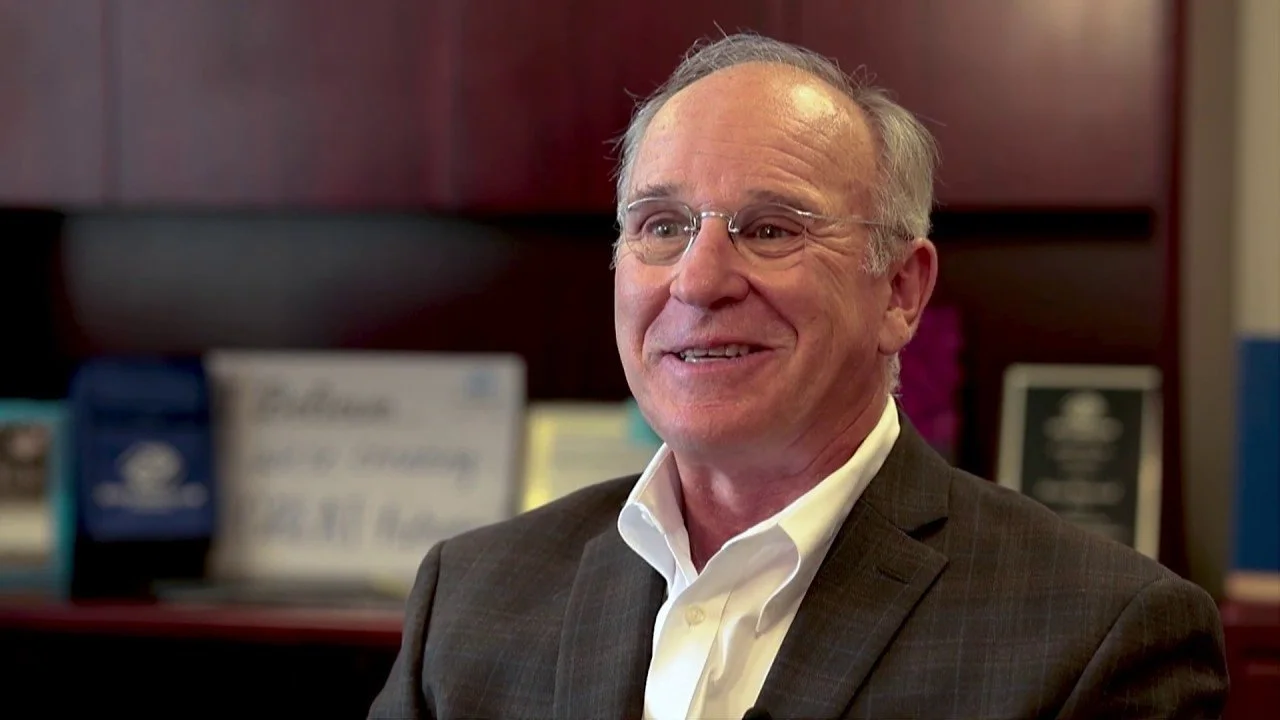

Joe Perras is president of Cheshire Medical Center in Keene, which a recent report lists as having negative trends that could potentially put it at risk of closing, but he says because the hospital is affiliated with the Dartmouth Health system it is ‘in a stronger position, albeit challenged.’ (Keene Sentinel photo)

The think tank declined to name the specific hospitals that might be facing closure, but said the data, especially the negative trend in profit margins among some hospitals over several years, indicates that hospitals might have to close or seek alternate ways to survive, such as being acquired or buoyed by larger entities that own the struggling hospitals.

The two New Hampshire hospitals with negative financial trends, the report says, are Dartmouth Health’s Cheshire Medical Center in Keene and Concord Hospital-Laconia.

Littleton Regional Healthcare is also in the red, but it agreed in September to affiliate with Dartmouth Health — an agreement that is under review by the state Attorney General’s Office. The fourth hospital with poor margins is Cottage Hospital in Woodsville.

“Although Cheshire Medical Center has had operating losses, we closed FY25 with a positive operating margin due to increased clinical volumes across the organization,” said Joe Perras, president of Cheshire Medical. “The report does not consider whether ‘at-risk’ hospitals are independent or part of larger health systems.

“In our case, fortunately, Cheshire is a member of the Dartmouth Health system, which puts us in a stronger position, albeit challenged. Barring some unforeseen circumstance impacting the entire health system, the risk of closure is of no concern due to our affiliation with the Dartmouth Health system,” Perras said.

Medicaid funding changes

There is hope for some possible relief that could help rural hospitals. The so-called One Big Beautiful Bill Act that Congress enacted in July includes significant upcoming cuts in Medicaid, a state and federal health insurance program for low-income and disabled people. However, that bill also includes a $50 billion payout, known as the Rural Health Transformation Fund.

Half of that $50 billion will be distributed to all 50 states evenly, which means $500 million to New Hampshire.

Some say the equal distribution offers an advantage to small states like New Hampshire, which would receive the same amount of money as much larger states, such as Texas and California. The remaining $25 billion will be distributed to states at the federal government’s discretion.

All 50 states, including New Hampshire, have applied to the federal Centers for Medicare and Medicaid Services, seeking a portion of the remaining $25 billion. A decision from the feds is expected by the end of the year.

Kathy Bizarro-Thunberg, executive vice president at the N.H. Hospital Association, says looming Medicaid cuts – expected to total $3 billion over the next decade in New Hampshire – ‘will further destabilize an already challenging rural health system.’ (Courtesy photo)

“Typically, hospitals in rural communities serve a higher percentage of Medicaid patients than other hospitals,” said Kathy Bizarro-Thunberg, executive vice president at the N.H. Hospital Association. “Because of the recent federal changes, all hospitals in New Hampshire will be impacted.”

She added, “Such changes will further destabilize an already challenging rural health system.”

Bizarro-Thunberg said the hospitals remain hopeful that the new funding will provide some support and stability, but “be certain — the Rural Health Transformation Fund will not make up for the amount of federal Medicaid cuts that will begin in 2028.”

It’s not just rural hospitals facing severe financial headwinds. A recent report from the N.H. Hospital Association found that seven New Hampshire hospitals had negative operating margins — four of them rural acute care hospitals.

Negative margins

In his analysis, Harold Miller, an adjunct professor at Carnegie Mellon University — and president of the Center for Healthcare Quality and Payment Reform, which published the report on potential rural hospital closures — shows that Cheshire Medical Center in Keene has been running negative margins for at least the last four years.

Average revenue from the two most recent cost reports available at Cheshire was $285.7 million, while expenses at the same time totaled $309.4 million, according to Miller.

Numbers for Concord Hospital-Laconia were similarly in the red: $137.6 million in revenue, $144.4 million in expenses, according to Miller. A spokesperson for Concord Hospital declined to comment.

Miller said it’s important to look at more than the margins. He said the source of payments to hospitals and inadequate reimbursement from private insurance companies are usually the biggest culprits in a hospital’s negative margins.

“Nationally, the biggest cause of rural hospital closures is private insurance,” Miller said. “Generally, what you’ll see is hospitals that you would have seen losing money are also the hospitals that generally are in the column that have negative numbers in the private insurance margin column.”

Miller cautions against labeling specific hospitals as being at risk for closing and creating a panic among patients, because hospitals may have other avenues for making up for losses, and his report does not account for that.

Transforming rural health

For its part, New Hampshire has established the Governor's Office of New Opportunities and Rural Transformational Health, or GO-NORTH, to help develop and implement a health transformation strategy for rural New Hampshire.

In a summary of a proposal the state submitted to the federal government last month to receive a portion of the $50 billion, it laid out broad scopes and did not provide specifics. It said the state will work to improve access to health care in rural areas and increase the number of rural health care workers and clinicians. It also hopes to help increase use of telehealth services and work toward the financial stability of rural hospitals and health centers.

Among the proposal’s suggestions:

• Foster healthy lifestyles in rural communities by “increasing access to healthcare services and investing in local infrastructure for transportation, nutrition, physical activity, mental well-being, and technology.”

• Use a “primary care and prevention-first model” by expanding rural primary care practices, integrating behavioral health, substance use and other unmet health needs.

• Improve community-based nursing that offers care in patients’ homes and other rural settings.

• Mitigate workforce shortages by “creating rural healthcare pathways” by partnering with high schools and colleges.

• Invest in “innovative staffing models” that include “simulation labs, mobile learning units, and earn-to-learn programs.”

• Expand medical training programs, including a rural residency program through the White Mountains Medical Education Consortium.

• Strengthen the “financial solvency” of New Hampshire’s rural health care system.

It is unclear whether the federal money being distributed to states will mandate that the money go directly to rural hospitals or rural communities.

While the state and rural hospitals are eagerly waiting to see how much of the $50 billion New Hampshire will receive, the looming Medicaid cuts — which are projected to total $3 billion over the next decade in New Hampshire — remain very worrisome.

“For hospitals and health systems, the financial consequences of these changes are mounting, with a number of hospitals continuing to experience negative operating margins,” said Bizarro-Thunberg of the state hospital association. “The outlook continues to place access to critical services at risk. Barely making ends meet or operating at a financial loss is not just bad economics. It impedes hospitals’ ability to deliver services, improve health outcomes and invest for the future.

“When Medicaid funding is dramatically reduced,” she said, “it affects more than just Medicaid patients. As a result, hospitals will have to review all their programs and services and make difficult decisions about which ones they can sustain in the face of severe government cutbacks.”

Critics say the language in the budget bill that includes the $50 billion Rural Health Transformation Fund is ambiguous and perhaps paradoxical. Despite the fund’s name, the bill does not mandate that the money go directly to rural hospitals or rural communities. It also caps the amount of funding that can be used for health provider payments, including rural hospitals, at 15 percent.

“In the end, what was characterized as a ‘rural hospital fund’ is really nothing of the sort,” said Adam Searing, an associate professor at Georgetown University’s McCourt School of Public Policy in a report he wrote in October. “The vast majority of RHTF funding is actually prohibited from directly benefiting health care providers, including rural hospitals.”

These articles are being shared by partners in the Granite State News Collaborative. Don’t just read this. Share it with one person who doesn’t usually follow local news — that’s how we make an impact. For more information, visit collaborativenh.org.